The Problem...

1. Segregating Savings

Customers were creating lots of accounts (4+) with different banks, goals & interest rates to keep control. No product was fulfilling this flexibility.

2. Backward Banks

Customers were aware of 'bait & switch' tactics employed by other banks. Most would raise rates to attract customers, only to drop them later.

3. Lack of Control

Customers wanted to be in the driving seat. They wanted to decide themselves when & how much to save. They felt best when able to often.

The Requirements...

- Encourage good savings habits

- Offer personalised choice & control

- Create single savings account for all

- Create fluid sign-up & pay-in journey

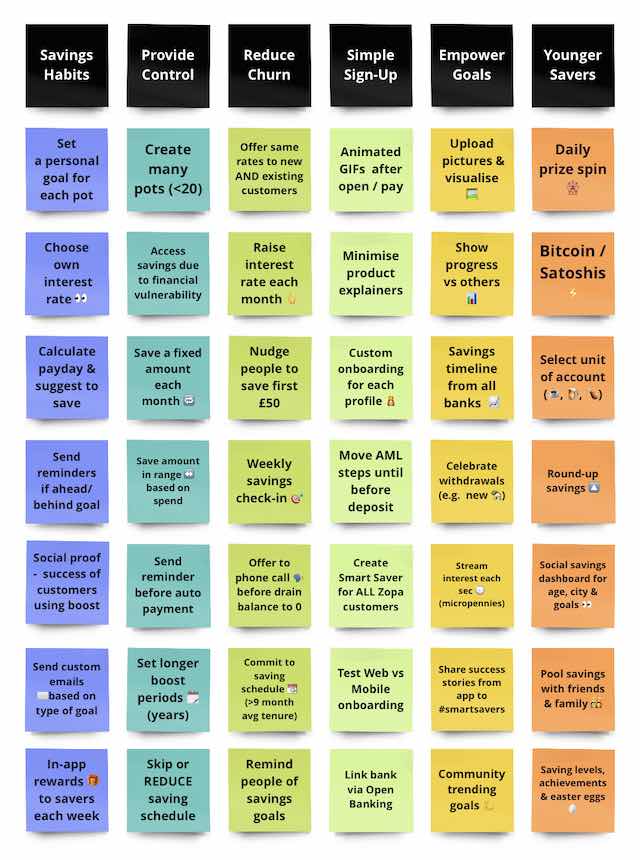

Research started with 8 detailed user interviews, multiple quantitative surveys were then conducted (external & internal), to understand customer needs & arrive at the core problem.

Team workshops focused around 'how might we' statements, helped the team brainstorm & land on a potential solution. Over the course of several sprints, we ran a further 16 usability tests of our designs to iterate down to the most intuitive experience.

The Solution...

Select a rate for each goal

2.86% AER

- Access savings 24/7

- For any rainy day

2.91% AER

- Access after 7 days

- For forming habits

3.06% AER

- Access after 31 days

- For future holidays

3.26% AER

- Access after 95 days

- For max interest

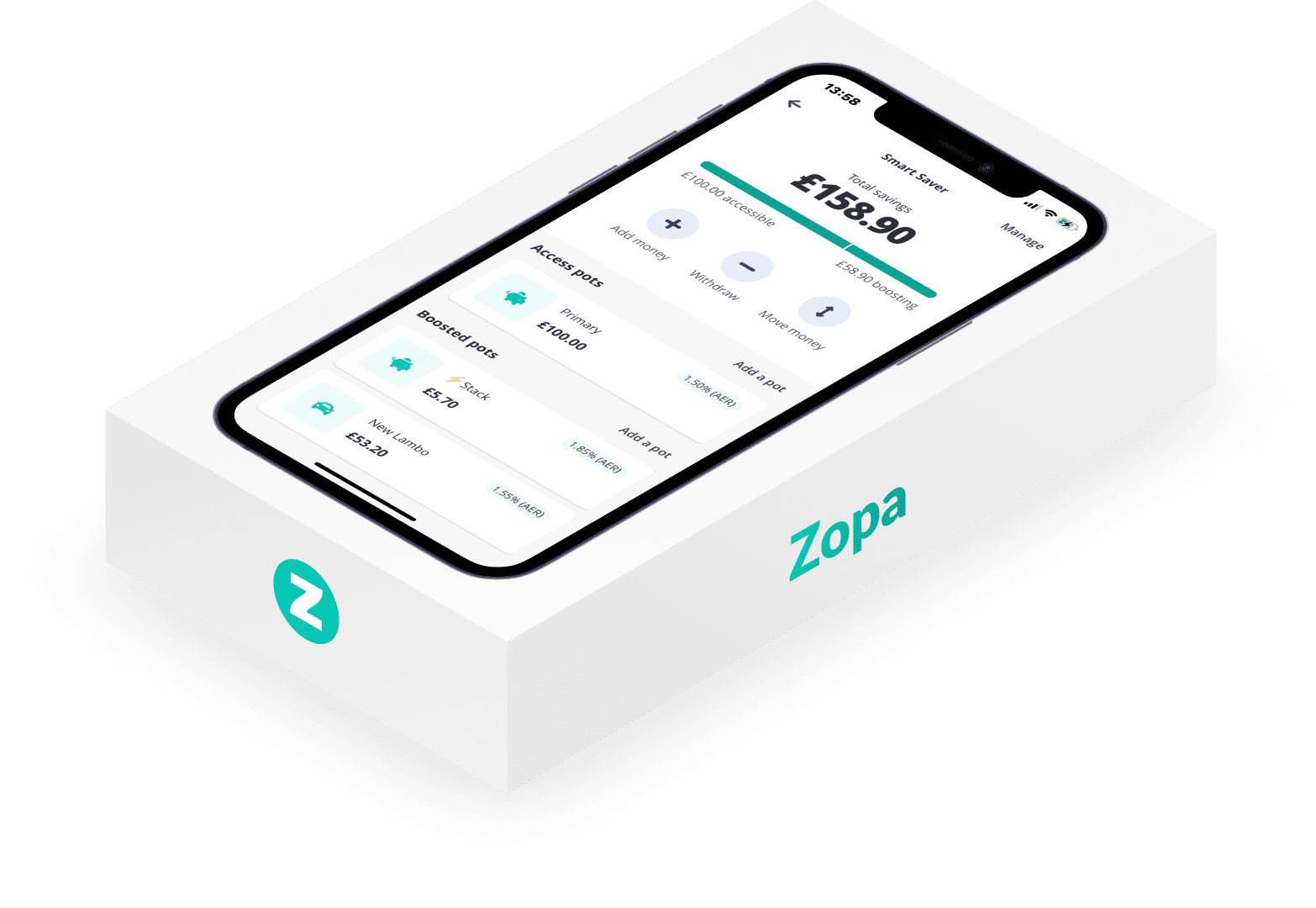

- Create a Zopa account and a new pot (Access) is ready to go, by default. ⭐

- Split your savings into as many as 20 pots. Choose whether to add an additional Boost to each! 🚀

- Boost pots are like mini 'notice accounts', i.e. to access & withdraw savings, notice must be provided. ⏲️

- Once the notice period ends, customers can Boost again, withdraw or keep savings ready to go always. ♻️

How it works

Customer Feedback

Comments from those using Zopa Smart Saver...

S M A R T S A V E R

Award-Winning

🏆 App-only Savings Provider of the Year

🏆 Consumers' Choice - Zopa Smart Saver

🏆 Zopa Tribe of the Year 2022

The Result...

Savings at the next level

A pot for every savings goal 🍯

Customers creating multiple pots were really engaged and becoming better savers as a result. Boosted pots instantly became the most popular option

Best of all worlds 🌎

Win-wins were evident for the bank & its customers. Customers could now adopt just 1 account, average balances soon doubled, the bank had certainty over retaining customer funds & the team had a successful launch to build from.

Boost became top feature 🥇

Customers later told us they had found the control they craved, without needing to search the market for new temporary savings accounts. Many were "strapped-in" for long-term savings & 41% increasing balances each month.

£300m

32k customers in just 6 months.

Unique launch in competitive market.

55%

Majority of savings in Boosted pots vs 5-10% in traditional notice accounts.

79

Average Net Promoter Score (NPS), highlighted Product-Market Fit.

The Learnings...

What was the biggest takeaway?

To always step back in future projects to truly understand how customers are using their products. Many customers were simply not aware of notice accounts at all and many had just not had an easy way to interact with or utilise them.

The team hypothesised 15% of savings would be in Boosted pots after launch, a 2x above the market. Instead we saw Boosted pots become more popular than traditional easy access pots, representing 55% of deposits (an 8x on the market) which was a HUGE discovery. One we wouldn't have found without the upfront & continued validation.

What was your favourite part of the project?

Speaking to customers about how to overcome their obstacles with money. Many customers had been lacking the motivation and incentives to save, during a period of record low interest rates.

It was incredibly satisfying to read people's comments after having tried the product (during its various iterations) for the first time. New insights arose after each sprint and it was incredibly motivating seeing the entire team appreciate this open feedback and evolve the product into the success it quickly became.

What would be done differently next time?

Going bigger on rates sooner. When we launched the product, we were mindful not to overwhelm the customer service department by going top of market on Day 1. This would have resulted in a huge wave of new sign-ups and potentially too many customer tickets for the team.

This was Zopa's first offering in the most popular UK savings market, yet in hindsight we would have attracted many more deposits & thousands more customers from Day 1, with a more competitive set of rates. Especially given that the UK press are very price sensitive.

This was rectified later, by offering the best rates on the market (every 3 to 4 weeks) and resulted in plenty of positive media coverage for Zopa.

How could the product be improved today?

From a solid base, there’s so much that can be done in future. Helping more people save their first £50, to increasing the number of pots/payments, to integrating fixed term accounts into the same product & more.

The biggest area of untapped growth may be truly understanding people's goals and personalising each type of pot. Crafting engaging copy & imagery that differs whether you are saving for a trip to Ibiza, for your 1st home or simply for a rainy day. Savings accounts are also much less interactive and engaging than current accounts or other finances apps. With that in mind, there was likely much more Zopa could do to keep people craving more savings.